香港中六經濟試卷

編號:

6665

學校區域:

香港九龍九龍城區

學校:

協恩中學

(HEEP YUNN SCHOOL)

年級:

中六 (F6)

科目:

經濟 (Economics)

年份:

2016-2017

卷種:

測驗

檔案格式:

pdf

頁數:

6

檔名:

F6Econ1617MidTermPaper2Ans

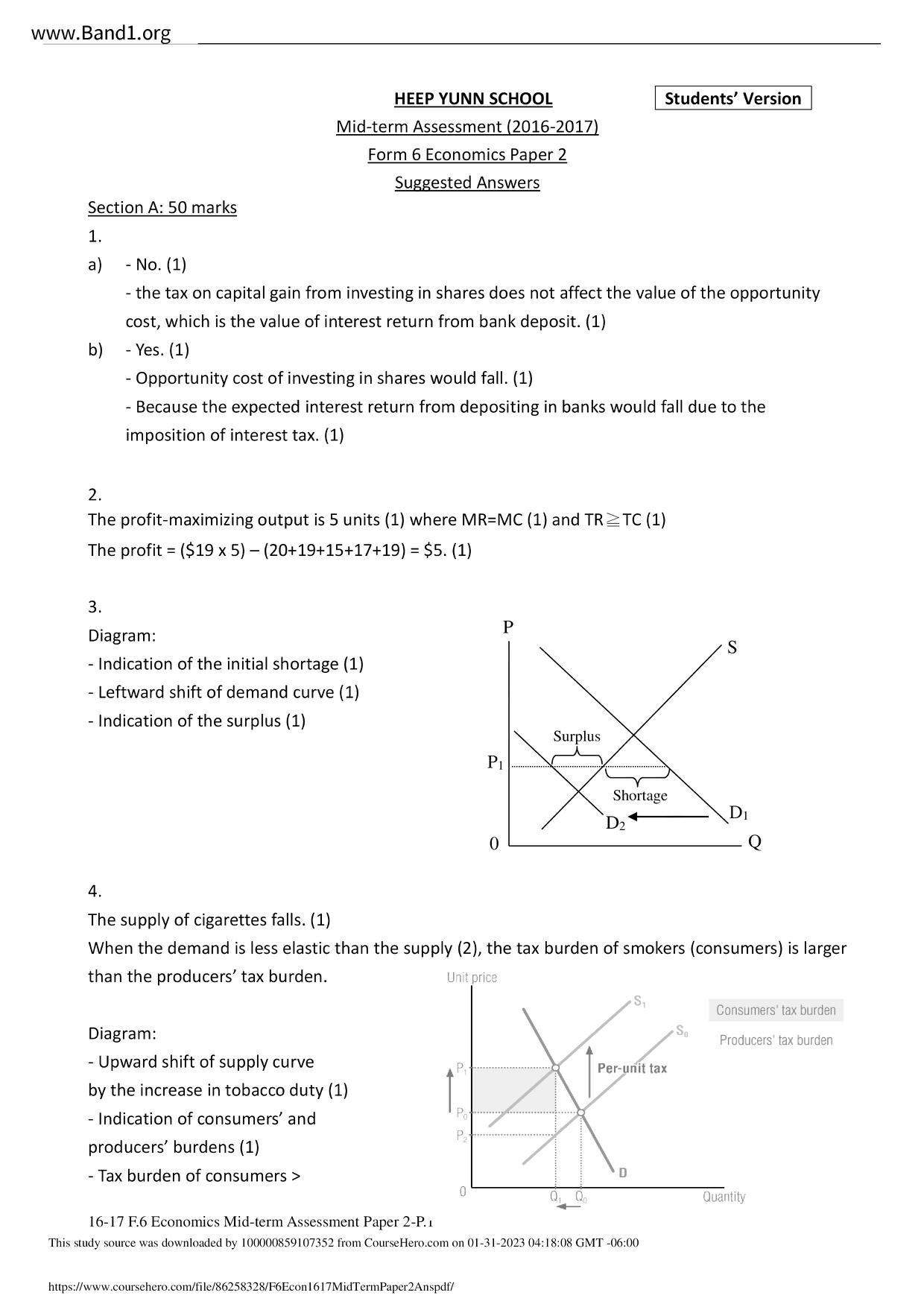

▼ 圖片只作預覽, 如欲下載整份卷, 請按「免費成為會員」 ▼

協恩中學 (名校卷)

▲ 圖片只作預覽, 如欲下載整份卷, 請按「免費成為會員」 ▲

▲ 圖片只作預覽, 如欲下載整份卷, 請按「免費成為會員」 ▲香港中六經濟試卷 PDF

下載試卷只限會員尊享