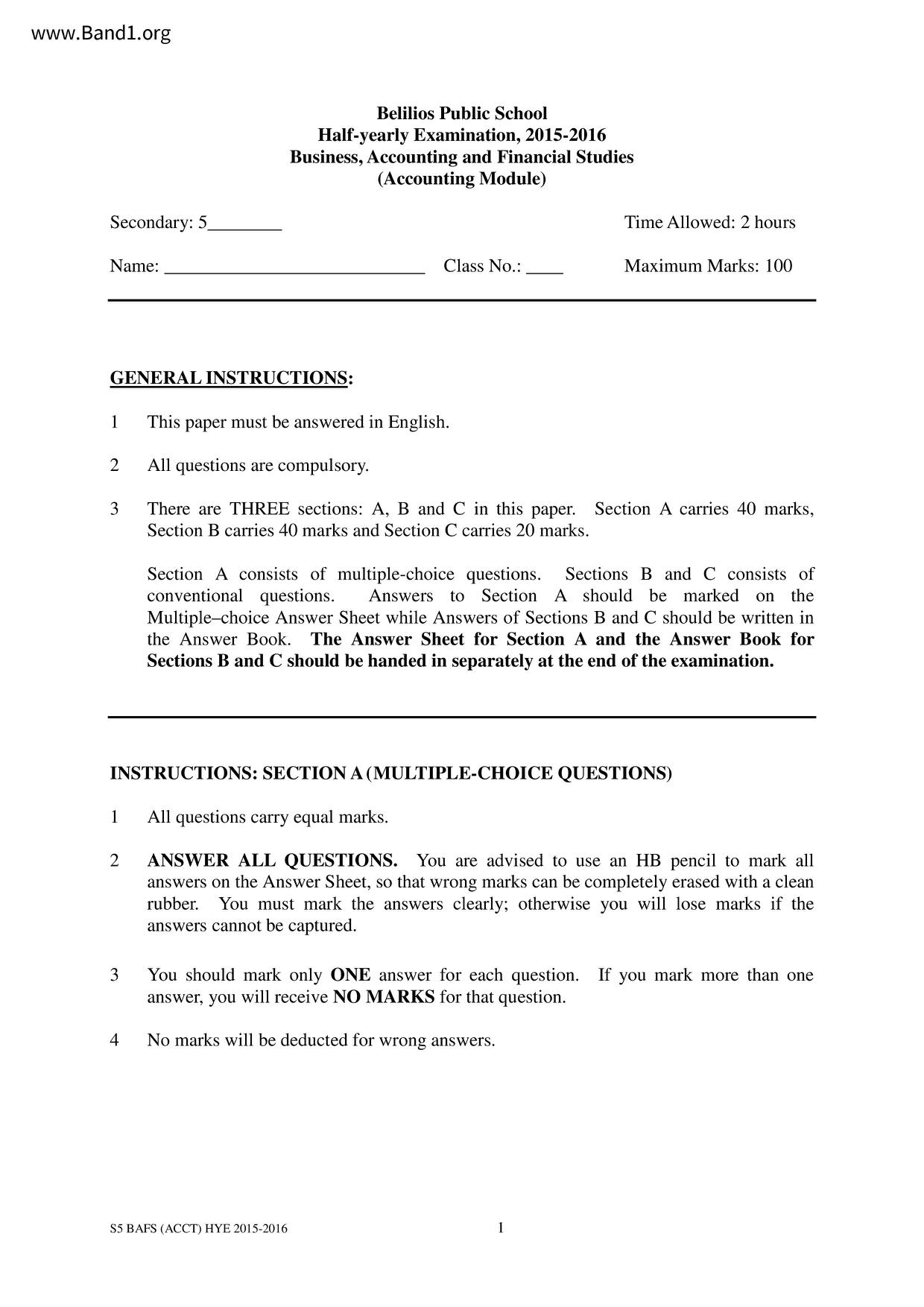

香港中五會計試卷

編號:

6639

學校區域:

香港港島東區

學校:

庇理羅士女子中學

(BELILIOS PUBLIC SCHOOL)

年級:

中五 (F5)

科目:

會計 (Accounting)

年份:

2015-2016

卷種:

考試

檔案格式:

pdf

頁數:

14

檔名:

Accounting PS_Half_yearly_Exam_Q_A

▼ 圖片只作預覽, 如欲下載整份卷, 請按「免費成為會員」 ▼

庇理羅士女子中學 (名校卷)

▲ 圖片只作預覽, 如欲下載整份卷, 請按「免費成為會員」 ▲

▲ 圖片只作預覽, 如欲下載整份卷, 請按「免費成為會員」 ▲香港中五會計試卷 PDF

下載試卷只限會員尊享